If you use part of your home as a photography studio or home office, chances are this is a big opportunity for a substantial tax write-off! Click below for a free download of the template I use to calculate my home office deduction:

Determining What Areas Qualify

The first step is to determine what areas of your home can qualify for the home office deduction. According to the IRS, you must:

- Regularly use this part of your home exclusively for your business

- Use this part of your home as your principal place of business or

- Meet patients, clients, or customers at home or

- Have a separate structure on your property exclusively for business purposes or

- Use part of your home to store inventory or product samples.

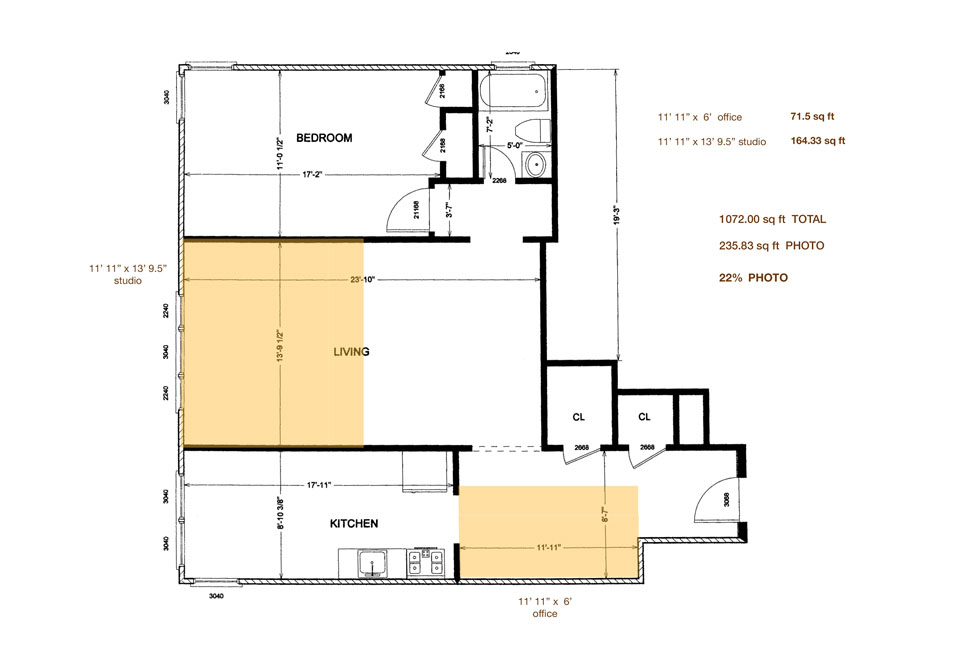

Here’s an example of how I set up my former Jersey City condo as my home office & studio:

Notice how only some of the areas would qualify as regular and exclusive business use. (For instance, even though I meet with clients in my living room, it cannot be included since I also use the area for personal reasons.)

Here’s another example of an apartment used as a home office & storage:

To calculate the percentage of square footage, first add up the total of business-only areas and divide by the total square footage of the home. (If you have a roommate, don’t include their space(s) in the total square footage of the home.)

Calculating Home Related Expenses

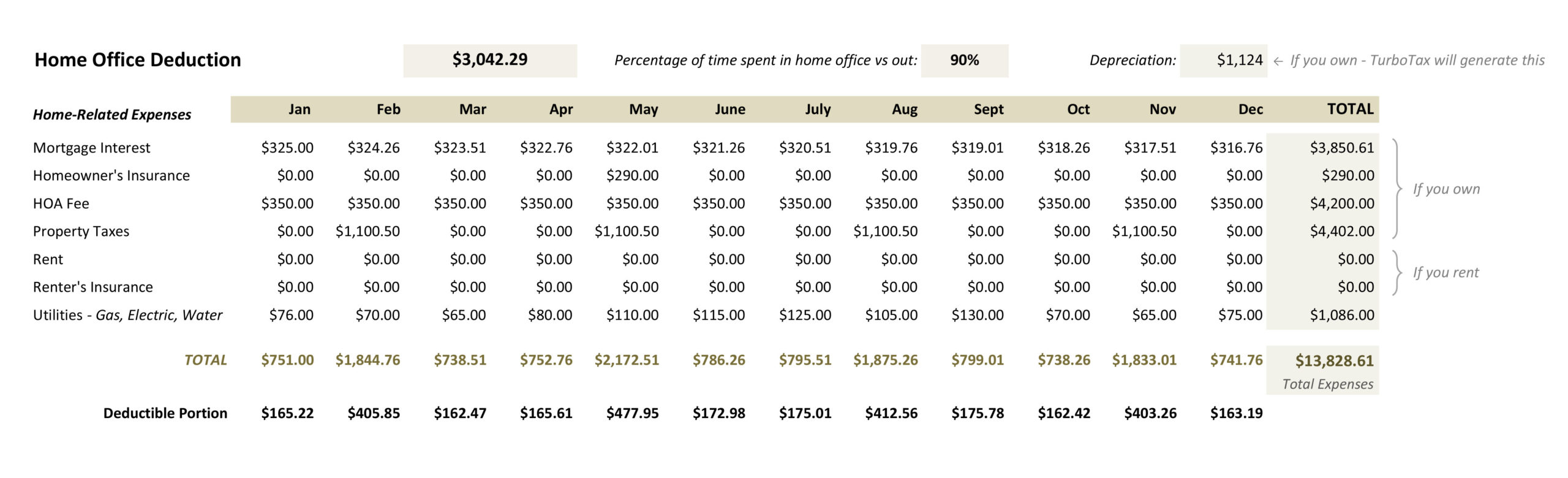

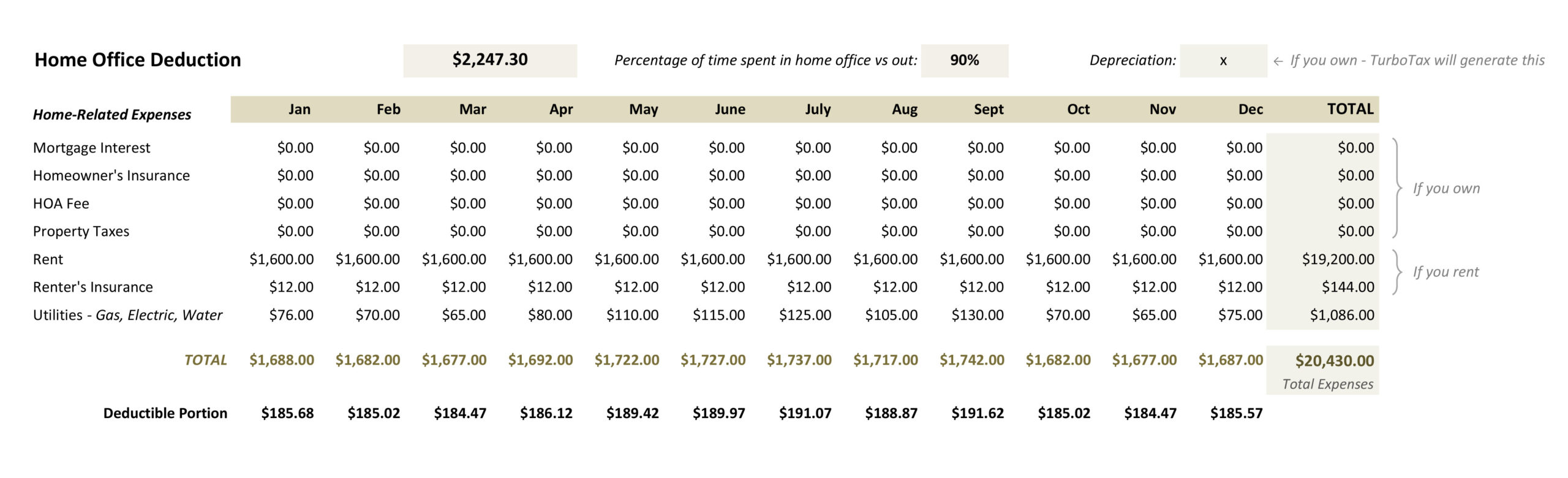

If you own a house or condo, enter your home-related expenses into the spreadsheet, including mortgage interest (not principal), homeowner’s insurance, HOA fee, property taxes, and utilities (gas, electric, water), etc.

If you rent an apartment or home, enter your rental expenses including rent, renter’s insurance, and utilities (gas, electric, water), etc. (If you have a roommate, don’t include any expenses paid by them.)

The total home-related expenses will be multiplied by the percentage of “business use” of the home to determine the tax deductible amount.

Percentage of Time

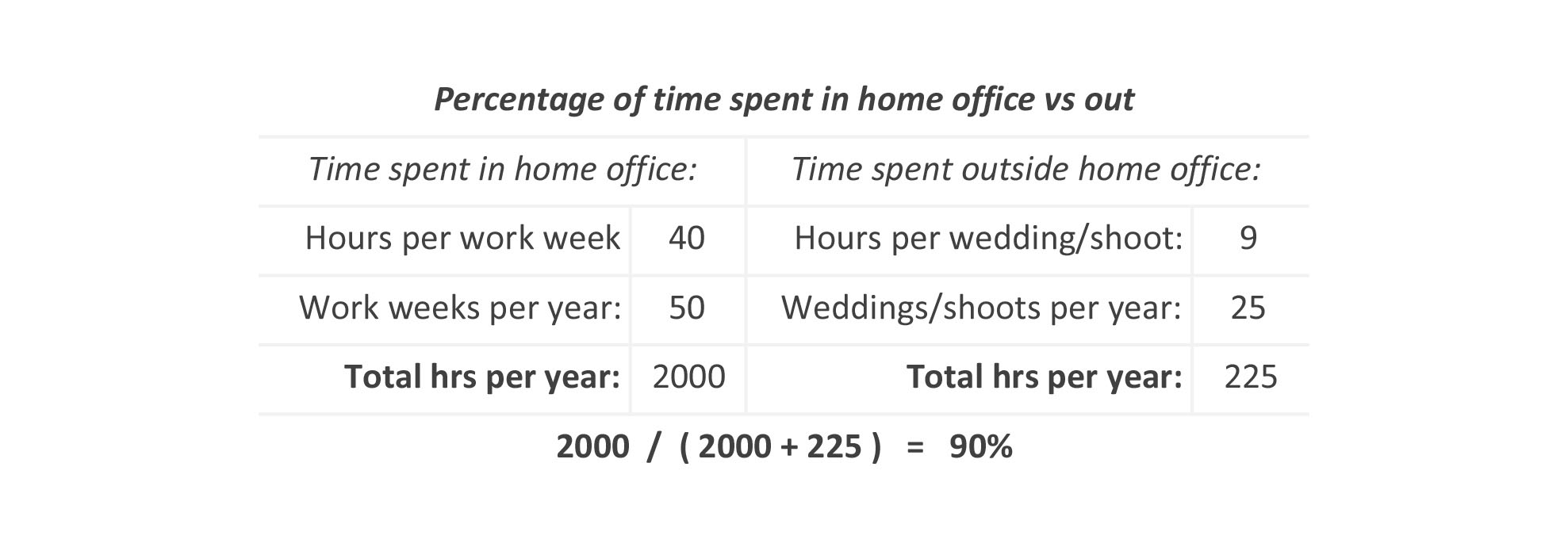

The IRS also requires that you disclose the percentage of time you spend conducting business inside the home office versus elsewhere. For example, for a wedding photographer that works in the home office 9-5pm during the week and on-location when shooting weddings, the percentage would be around 90%:

If you have any questions, feel free to leave them in the comments!

📷

Click here for more educational blog posts & free resources!

March 1