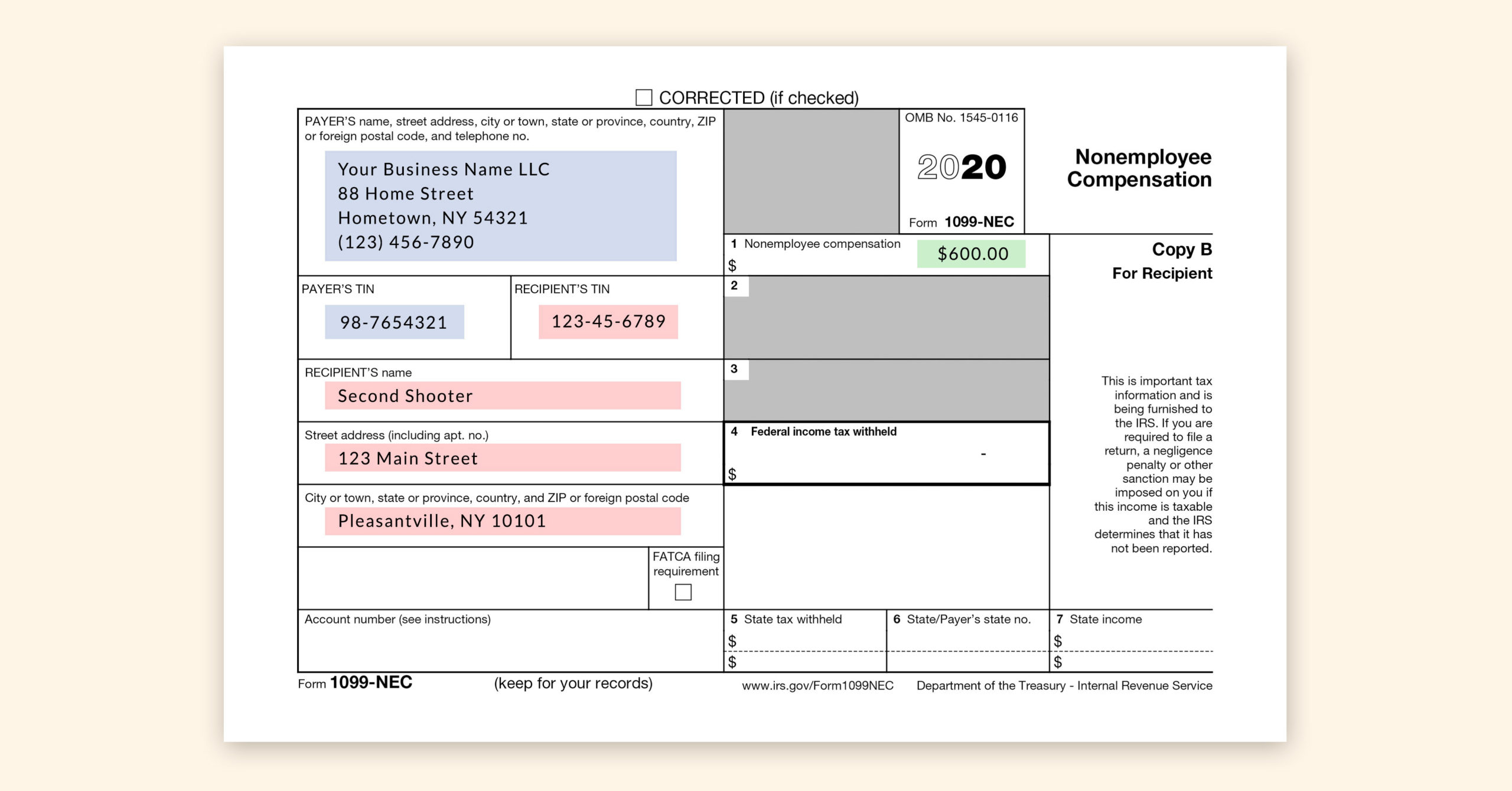

We all know that the IRS just loves throwing a wrench in our tax filing systems. Well, I hate to be the bearer of bad news… but it’s not actually that bad (just a change in paperwork): If you hired any independent contractors throughout the year (second shooters, assistants, etc) that earned $600+, you used to have to […]

January 20

The extended tax deadline is less than a month away! My biggest tip for making tax prep painless is to make sure your tax deductions are categorized correctly. Here’s a cheat sheet of some typical expenses you can write off as a photographer and how I recommend you categorize the transactions in your bookkeeping […]

April 20

If you use part of your home as a photography studio or home office, chances are this is a big opportunity for a substantial tax write-off! Click below for a free download of the template I use to calculate my home office deduction: Determining What Areas Qualify The first step is to determine what areas of your […]

March 1

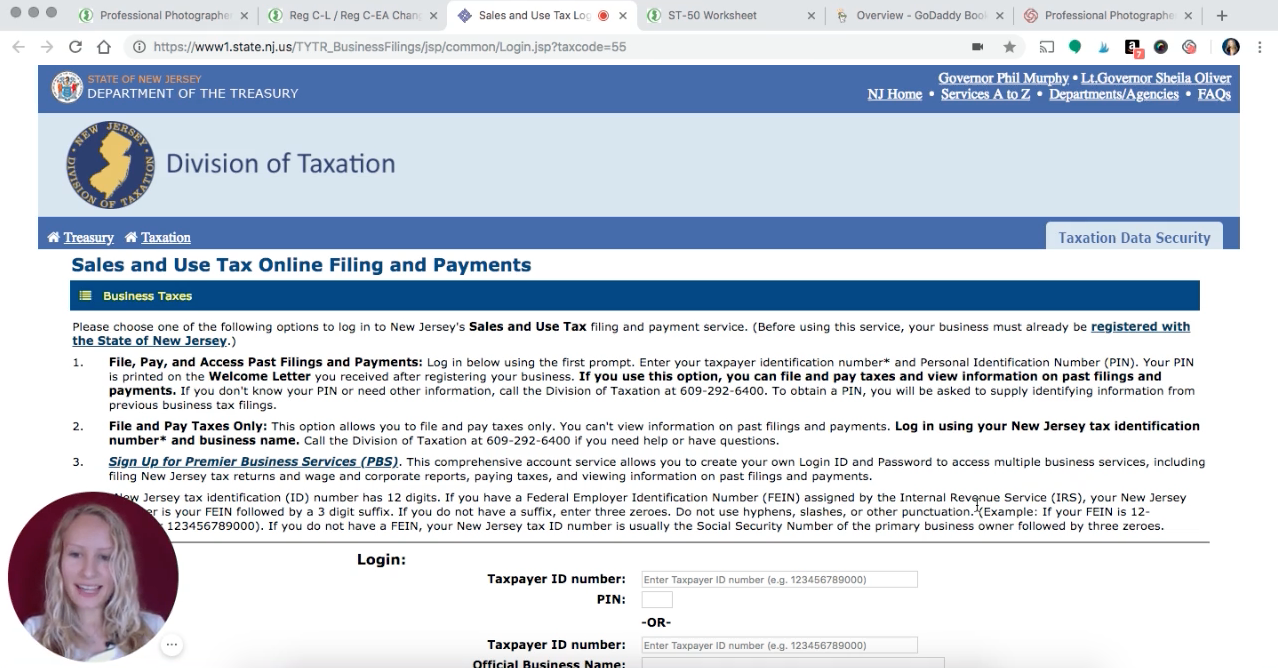

If you’re a professional photographer in the state of NJ, chances are you might be required to collect sales tax for some of your products. Here’s a video explaining what types of sales are eligible, how to register to collect taxes, and how to remit your taxes to the state: TIPS & RESOURCES: […]

October 17