If you’ve decided that this is the year that you’re going to make your business official – hooray!

After creating an LLC, the first step towards separating your personal and business finances is creating a Small Business Checking Account.

Keeping your accounts separate is not only required in order to maintain your “corporate veil” and be able to take advantage of your Limited Liability status in the event of an issue, but it also makes it easier to track your income & expenses, keep good bookkeeping records, and see your business’s overall performance & growth.

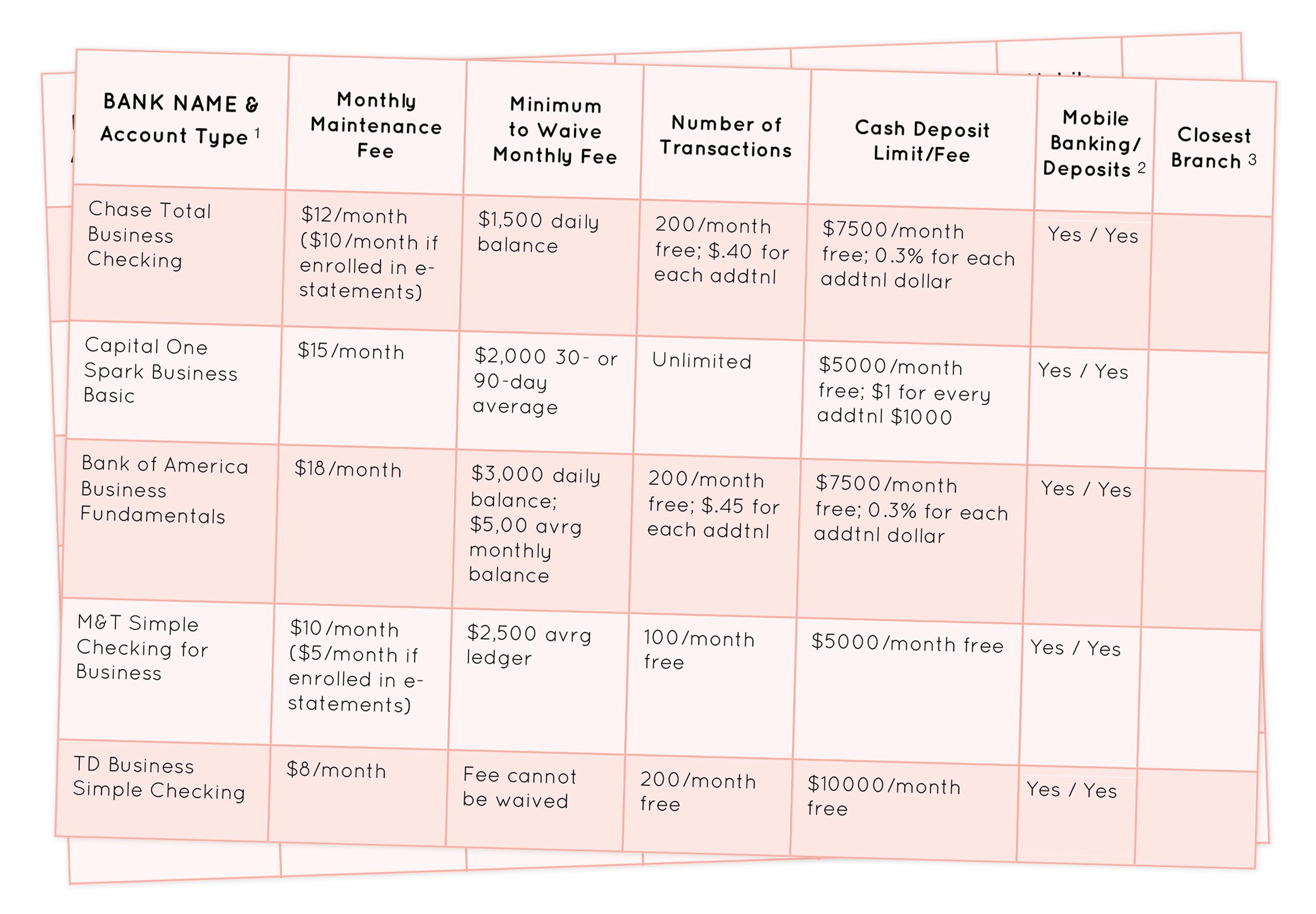

Here is a chart of all the account options that a few major banks offer. You can also do your own research and fill out your results in the comparison chart below:

Some key things to look out for:

- Most banks typically offer more than one business checking account option for different needs and companies of various sizes and types. The basic/simple option is usually a good fit for photographers.

- Another factor to consider: Is there a limit for mobile deposits? If you frequently receive large checks above this limit, this may be a significant factor. You may be able to talk to a representative at the bank to see if the limit can be raised.

- If there are no physical branches near you, you may want to eliminate that option. When you receive a cash payment (or a check above your mobile deposit limit) from a client, you will need to physically deposit the cash at a local branch.

You may also want to look into smaller banks or credit unions, or talk to a representative at the bank to see if you can negotiate or haggle down the monthly fee. After all, they need your business and much as you need them!

Business Credit Card

Now that you have a bank account all set up, you can apply for a business credit card. (Just remember to pay it off in full each month if you don’t want to rack up debt and waste your hard earned money on interest!)

I love the Chase Ink Business Preferred credit card – 3x points on select categories and 1x points on all purchases. An awesome added bonus: If you spend $5000 in the first 3 months, you’ll be rewarded 80,000 points (that’s ~$1000 towards travel)! And if you’re buying a new camera body or lenses, or any other upgrades or start-up equipment, it’s easy to get up to that $5000.

📷

Click here for more educational blog posts & free resources!

January 30